Adulting 101: All You Need to Know about Income Tax in Singapore

- Financial Fortress

- Mar 28, 2022

- 4 min read

Updated: May 9, 2022

Taxes serve as our contributions to the nation-building of our country. Under the law, anyone who draws or derives an income is mandated to pay an income tax.

It’s a good thing that our income tax rate is one of the lowest in the world, so only a small percentage of your monthly salary goes to our taxes!

Understanding how taxes work in Singapore can get a bit confusing, though, especially if you’re a fresh graduate who’s new to the workforce.

To help you get started, we’ve put together a quick guide on what you need to know about income tax in Singapore. From who needs to pay, down to tax deadlines, we’ll run through everything!

Who needs to pay income tax in Singapore?

According to IRAS, income tax is paid by individuals who earns, receives, or derives an income in Singapore, unless exempted under the Income Tax Act or by an Administrative Concession.

You will need to pay income tax in Singapore if you fall into any of the following:

Individuals working in Singapore.

Those who receive payments for any form of employment in Singapore.

Individuals working outside Singapore.

Those working outside Singapore whose overseas employment is incidental to the Singapore employment.

Individuals with business in Singapore.

Self-employed individuals such as freelancers, sole proprietors, taxi drivers, and hawkers, among others.

Individuals with investments in Singapore.

Those who derive income from their investments in property, unit trusts, fixed deposits, and shares in Singapore.

Non-working individuals but receiving income.

Those whose incomes are derived from investments, part-time employment, pensions, and retirement schemes.

What can be taxed?

Not all forms of income derived in Singapore are taxable! So your entire annual earnings may or may not be taxable, depending on how a portion of them were earned.

It’s worth keeping in mind that income taxes are calculated based on the income earned in the preceding calendar year.

The forms of income in Singapore that can be taxed are employment income, self-employment income, salary bonus, and rental income,

Meanwhile, your income from pensions, CPF life payrounds, capital gains from investments, and lottery winnings aren’t subjected to tax!

How much tax do I need to pay?

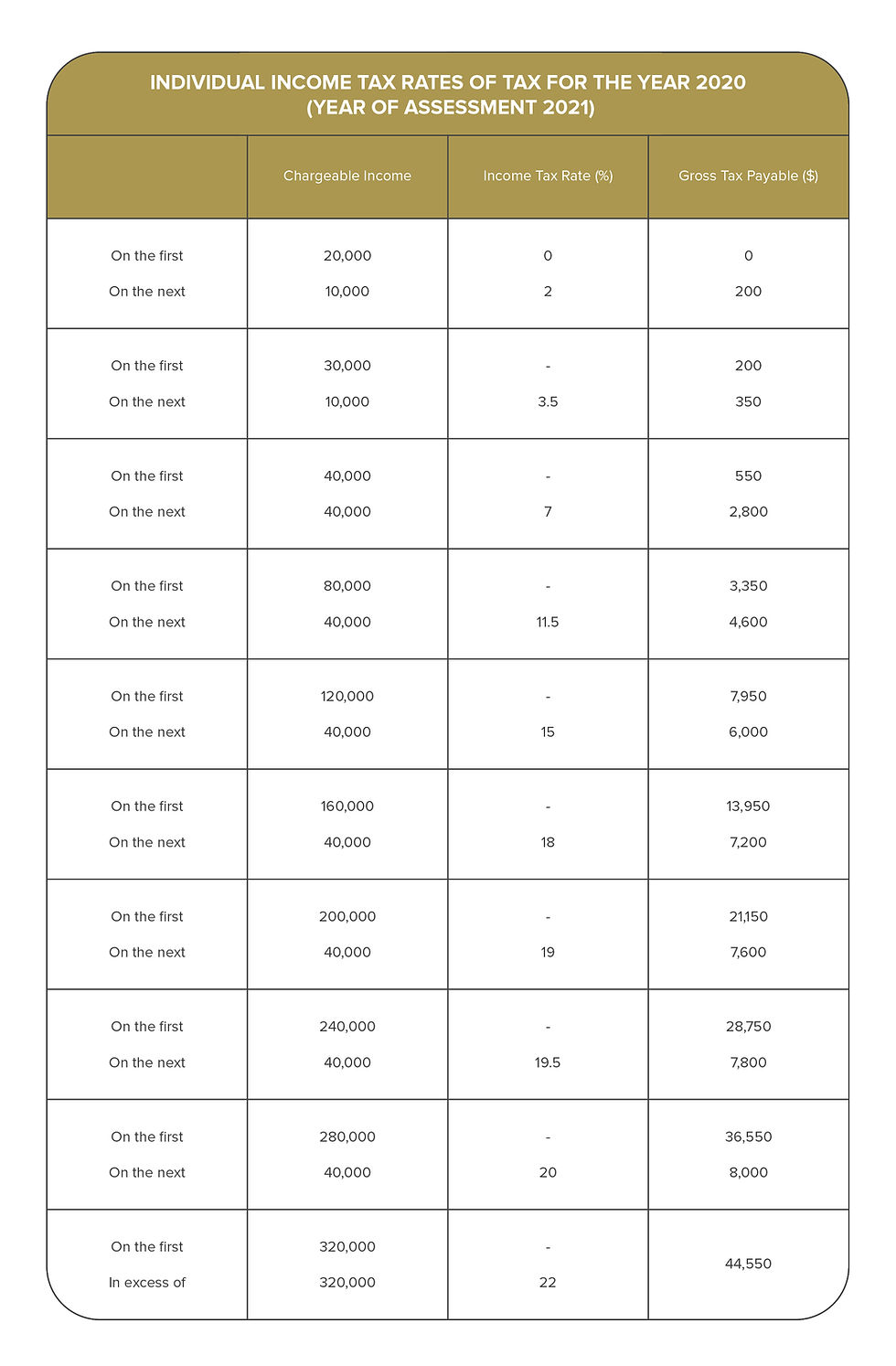

Fortunately, Singapore’s tax system follows a progressive tax rate! In other words, the higher your income, the higher your tax will be.

Here’s the structure of Singapore’s tax rates based on income:

The good news is, you can be entitled to tax reliefs depending on your situation. Your final tax bill will be reduced depending on which tax reliefs you qualify for.

You can receive tax reliefs in Singapore if you’re taking care of elderly parents, a foreign domestic worker, a National Serviceman, or a working mother. You’re qualified if you have a newborn or live with a handicapped spouse, parent, or sibling as well.

You can know more about how tax reliefs work in Singapore on IRAS’s website.

When to file income tax in Singapore?

Income tax is calculated based on your earnings up to 31 December of the preceding year.

Based on the tax calendar, you’re obligated to file for your annual personal tax returns to IRAS by 15 April of the following year.

You’ll receive a copy of your tax bill showing you how much you’ll need to pay after filing. Keep in mind that you have one month from the date of receiving your tax notice assessment to settle your taxes!

How to file income tax in Singapore?

You can file your taxes either through paper or electronically. The easier way is to file your taxes online, which is what most taxpayers do to save time and reduce the stress of tax filing.

You need to remember these 3 things you need to remember when filing your income tax in Singapore:

Income

Declare all forms of income derived in Singapore, including employment income, rental income, vocation income, and any other relevant taxable income.

If your employer follows the Auto-Inclusion Scheme (AIS), there’s no need to declare this income details yourself. This information will already be pre-filled in the tax forms.

Expenses

List down all expenses incurred while deriving your income. Example: employment expenses and business expenses.

Tax reliefs and rebates

Apply for tax reliefs you believe you qualify for to reduce your income tax. Taking care of an elderly parent or disabled spouse makes you eligible for tax reliefs.

Here’s what you need to do if you’re planning to file your taxes online:

1. Prepare documents such as SingPass, Form IR8A, particulars of dependents, and details of rental income, if any.

2. Log in to myTax Portal using your IRAS account and then follow the instructions.

3. Input details such as your income, deductions and reliefs.

4. Declare other sources of income, if any.

5. Finally, save a copy of the acknowledgement receipt.

How to pay income tax in Singapore?

There are many ways to pay your tax bills in Singapore, including through GIRO, bank transfer, and even selected ATMs.

You may use credit cards too, but take note that tax payments don’t qualify for credit card rewards!

You’re given a total of one month from the date of receiving your tax assessment to pay your taxes, even if you have filed an objection and are still waiting for the results.

What happens if you miss the deadline?

As with credit card dues and loan repayments, you’ll incur late charges that will grow into more penalties until your taxes get settled. Missing the deadline means a penalty of 5% and an additional 1% for every month.

If you can’t pay your taxes in full, you can opt to pay in instalments through GIRO for up to 12 months, with no interest.

Adulting and dealing with taxes in Singapore

Filing and paying taxes is part of being an adult in Singapore. Yes, it can be confusing and overwhelming at first, but once you get the hang of it, filing taxes can be like a walk in the park.

It’s quite a relief knowing that Singapore follows one of the lowest income tax rates in the world, so it doesn’t feel like all your earnings only go to taxes.

Anyway, if you want to know more about IRAS and income tax, send us a message! We can connect you with financial experts who can help you learn the ropes of Singapore’s tax system and start with financial planning.

Comments